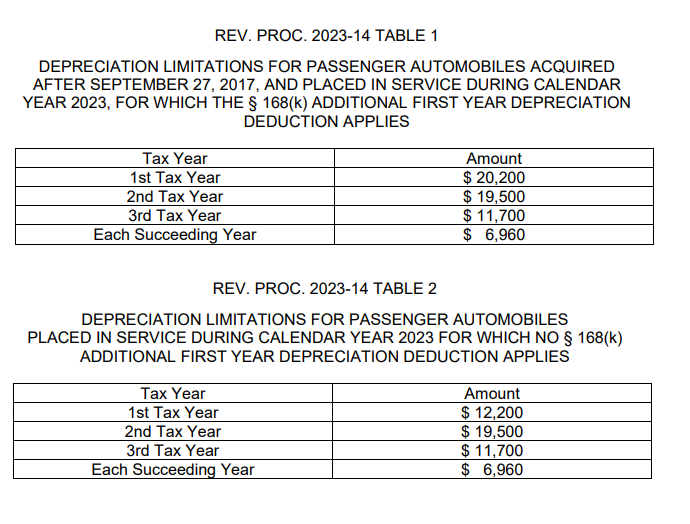

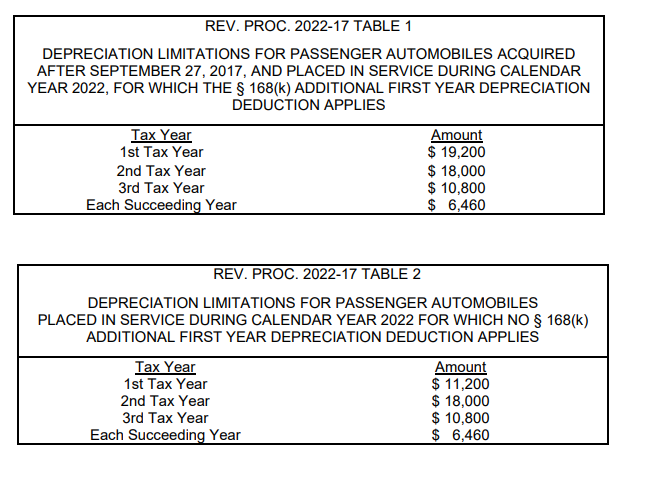

Irs Vehicle Depreciation 2024 – If bonus depreciation does not apply, the 2024 first-year limitation is $12,400 The dollar amounts, for each tax year during a lease, are correlated to ranges of vehicles’ fair market value. For . Each year, the IRS adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax provisions. This article highlights the key charitable figures for 2024. .

Irs Vehicle Depreciation 2024

Source : www.section179.orgIRS Updates Auto Depreciation Limits for 2024

Source : www.eidebailly.comTax Penalties, Section 179 and Bonus Depreciation Changes for the

Source : www.dtnpf.comIRS Updates Auto Depreciation Limits for 2023

Source : www.eidebailly.com2024 IRS Mileage Rate: What Businesses Need to Know

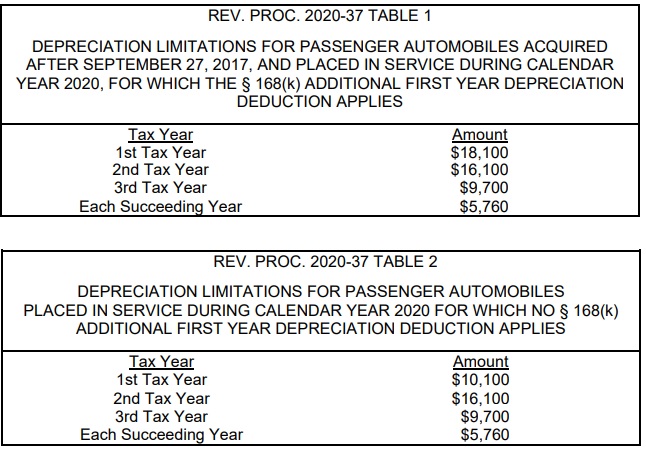

Source : www.motus.comIRS Updates Auto Depreciation Limits for 2020

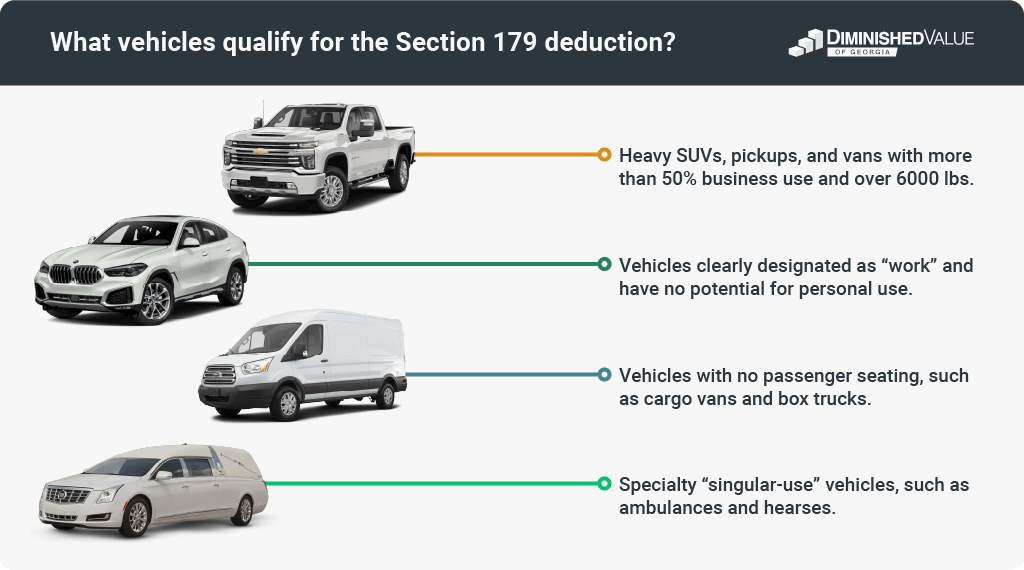

Source : www.eidebailly.comList of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in

Source : diminishedvalueofgeorgia.comIRS Updates Auto Depreciation Limits for 2022

Source : www.eidebailly.comIRS Mileage Rates 2024: What Drivers Need to Know

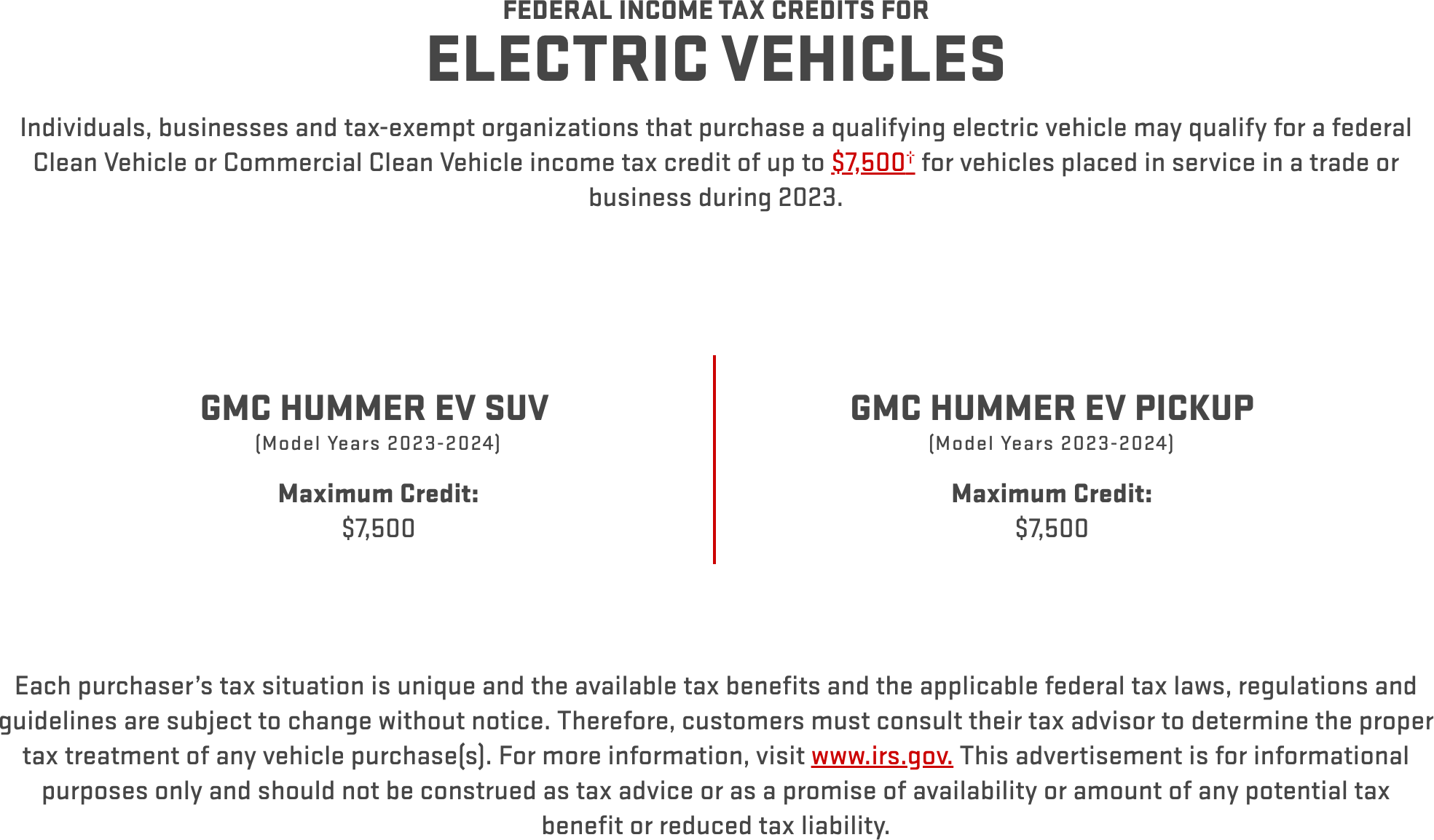

Source : www.everlance.comUnderstanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.comIrs Vehicle Depreciation 2024 Section 179 Deduction – Section179.Org: The Internal Revenue Service vehicles for business use. The standard mileage deduction rose to 67 cents per mile, up 1.5 cents from 2023. The change will go into effect for the 2024 tax . If you use your car for business purposes the percentage of bonus depreciation will decrease by 20% each year, as follows: The 2024 tax season has introduced many significant tax changes .

]]>

.png)